Bitcoin Miners Defy Price Dip as Network Difficulty Surges 6% to Record High

BTC Price Volatility Sparks Concern, but Miner Confidence Remains Strong in the Network

Despite the downward trajectory of BTC prices, the unwavering confidence of Bitcoin miners in the network is evident.

Bitcoin Mining Difficulty Rebounds from Slump

The core foundations of the Bitcoin network are showing no inclination to mirror the bearish price action of BTC this week.

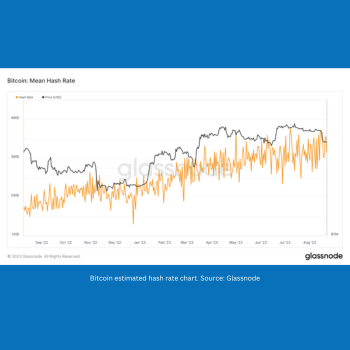

Fresh on chain data verifies that the network's difficulty has surged to unprecedented levels, with the hash rate closely trailing behind.

Despite a 10% drop in BTC/USD value last week, Bitcoin miners seem to be weathering the storm of price decline with resilience.

This was reaffirmed by network activity on August 22nd, as the difficulty spiked by 6.17% during its latest biweekly automated adjustment.

Not only did this propel the difficulty to new record heights, but it also marked the sixth largest increase in difficulty for Bitcoin in 2023, according to data from the monitoring resource BTC.com.

Difficulty serves as a mirror to both miner competition and the security of the Bitcoin network. The upward trajectory implies that miners are not yet grappling with profitability issues.

The next scheduled automated adjustment is poised to maintain this trend, pushing the difficulty over 56 trillion for the very first time.

Hash Rate Reflects Strong Confidence in Bitcoin Network

A similar narrative holds for hash rate—the estimated computational power allocated by miners to the Bitcoin blockchain.

Though exact calculations are elusive, hash rate is already challenging the existing all-time highs of over 400 exahashes per second (EH/s), depending on the source.

In response to this data, MAC_D, a contributor to the on-chain analytics platform CryptoQuant, pointed to the "strong confidence in the security and reliability" among network participants, encompassing both Bitcoin and the major altcoin Ether.

"Recent drops of -10% in BTC and ETH prices haven't dampened the increased security and reliability of the network. Firstly, the BTC hashrate (SMA 14) shows higher figures during the decline, indicating heightened mining activity. Secondly, the ETH staking rate (%) illustrates more ETH being staked despite the price drop," MAC_D wrote in a Quicktake market update on August 22nd.

"This implies that investors have robust confidence in the security and reliability of both BTC and ETH networks. The fact that prices have decreased despite an increase in the intrinsic value of these assets suggests they are undervalued, possibly signaling an opportune time to actively accumulate assets."

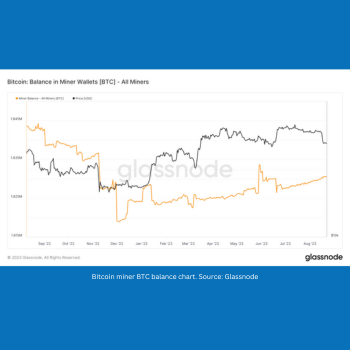

Separate data from the on chain analytics firm Glassnode reveals minimal tangible changes in the amount of BTC held by mining entities.

As of August 22nd, this figure slightly surpassed 1.83 million BTC, indicating a steady increase of 0.08% since the start of the month.

Welcome Bonus | Register in OKX | Cryptocurrency Bitcoin Registration | 56749236

Sign up and log in OKX App to claim a Mystery Box up to $10,000.

www.okx.com

댓글